One of the biggest challenges businesses face in 2025 is understanding tax laws.

For example, one of their questions is whether the purchase of office furniture is tax deductible or not.

Then let’s check the answer to this important question!

Is office furniture tax deductible? Yes, office furniture can be tax-deductible in 2025. Businesses can deduct the cost of furniture as a capital expense if it meets specific requirements, such as being used for business purposes and having a useful life of more than one year.

Additionally, small businesses may qualify for Section 179, allowing them to deduct the entire cost in the year of purchase.

Consult with a tax professional for specific deductions and rules applicable to your situation.

With changes to the tax laws coming in 2025, tax law awareness is becoming increasingly important for businesses, large and small.

For example, Section 179 and special depreciation provisions in 2025 provide businesses with opportunities to manage their office furniture costs more efficiently.

Also, how you record your office furniture Houston costs has a direct impact on your financial balance sheet, tax liability, and cash flow.

Therefore, being aware of these laws and using them can go a long way in reducing costs and increasing the profitability of businesses, especially small businesses.

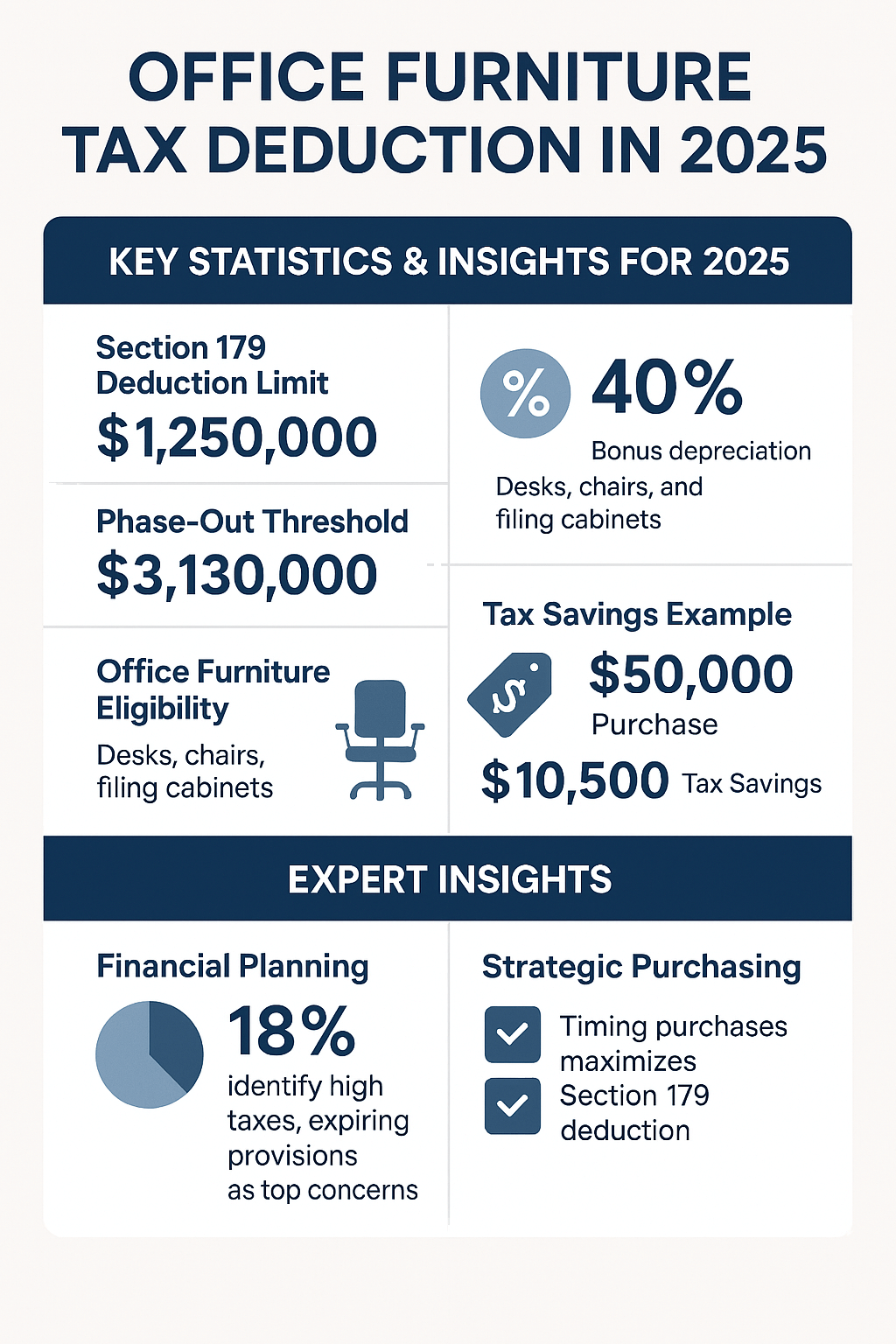

Check out this infographic about the key strategies and insights for 2025:

Definition of Office Furniture for Tax Purposes

According to tax standards and laws, office furniture includes physical, durable, and long-lasting items used in the day-to-day operations of a business.

This definition does not include consumable office supplies or information technology equipment (such as computers and monitors), which have different tax classifications.

What office furniture is tax deductible?

All businesses want to know if the money they spend on office furniture is tax deductible.

Under tax law, some types of office furniture qualify as a business expense, while others may not.

Most office furniture that is tax deductible usually has a specific lifespan. Here are some examples:

- Office Desks: Conference Tables, Executive Desks, Staff Desks, and Reception Desks.

- Office Chairs: Staff Chairs, Sofas or Lounge Seating, Conference Room Chairs, and Waiting Chairs.

- Storage Solutions: Filing Cabinets, Bookcases, Storage Cupboards and Drawers, Credenzas,

- Office Partitions and Dividers: Office Cubicles and Workstations, Partition Walls.

Items That Are Not Deductible

While many office furniture items are eligible for the tax deduction, some items are exempt from the tax for various reasons. These include:

- Office supplies: Such as paper, pens, staplers, printers, and other small items that are constantly being replaced.

- Personal or decorative items: Such as artwork, houseplants, or decorative items whose primary purpose is to enhance the work environment rather than to increase productivity and profitability.

- Home furniture used in a home office: If the furniture is a combination of work and personal use, only a portion of it may be eligible for the tax deduction.

But if furniture purchased directly for personal use is not deductible.

For example, if a business purchases furniture for its executives’ home office that is used for personal use, this purchase cannot be deducted from taxes.

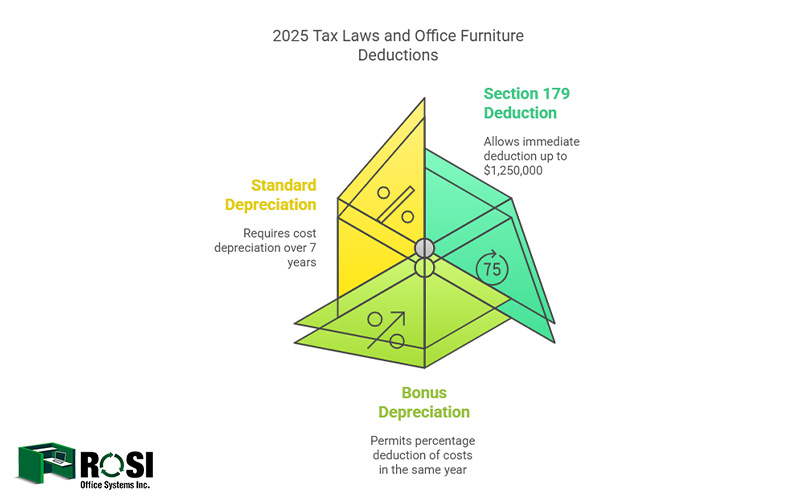

2025 Tax Laws and Office Furniture Deductions

As mentioned, in 2025, there were changes in tax laws and the method of tax deduction for office furniture, which we will discuss below.

1. Section 179 Deduction

One of the most important changes to the tax law in 2025 is that: According to section179.org, businesses can deduct up to $1,250,000 of office furniture purchased in the same year as a business expense.

The purpose of this section is to allow businesses to claim the full deduction instead of having to wait several years for depreciation benefits.

Of course, the tax limits for the Section 179 deduction still apply, and a specific limit has been set..

If the total purchases of the business exceed this limit, the amount that can be deducted from the tax will be reduced.

These changes provide good financial opportunities compared to previous years, especially in the situation of small businesses that make purchases in this range.

2. Bonus Depreciation

This also allows businesses to deduct a percentage of the cost of purchasing office furniture in the same year it is purchased.

While the Section 179 deduction is more likely to apply to items that are considered long-term assets, bonus depreciation allows businesses to take advantage of immediate depreciation.

3. Standard Depreciation

If your office furniture purchase does not qualify for Section 179 or bonus depreciation, the standard depreciation method must be used.

In this method, the business must depreciate the cost of the furniture over 7 years.

This means that businesses can claim a percentage of the cost of the furniture as a tax-deductible expense each year.

Note: It is important to note that federal tax laws may differ from state tax laws.

Some states may have specific deduction limits or additional state taxes that directly affect the deduction for office furniture purchases.

If your business operates in multiple states or is planning to relocate to another state, be sure to seek tax advice and familiarize yourself with your state laws to make the most of your tax benefits.

You Might Also Enjoy: Top 10 Places To Buy Office Furniture In Houston [2025 Update]

How can office furniture be tax deductible?

Considering the useful life of office furniture

One of the factors that determines whether office furniture is tax deductible or not is its useful life.

According to tax laws, office furniture must be used in the business for about 5 to 7 years.

This means that for furniture that has high costs, it is possible to deduct it in the form of depreciation.

In this case, the depreciation amount can be deducted from the business tax each year. Therefore, its cost is gradually deducted from the tax over a certain period of time.

Accurately record expenses

In order for a business to deduct the cost of purchasing office furniture from taxes, it must accurately record the expenses in its financial books.

Keep documents and invoices for auditing and detailing.

By fully recording how the furniture is used, you ensure that the furniture purchased is used only for business activities and not for personal use.

By doing this, any errors in tax filing will be avoided.

Type of use of office furniture

If the furniture you purchase is used for business purposes and not for personal use, you can deduct its cost from your taxes.

Maybe misuse of business assets has tax and legal consequences.

To prove this, you should create a detailed record-keeping and documentation system in your company so that the use of the furniture can be clearly traced.

To do this, you should record the location of each piece of office furniture, its purpose, the names of the employees who use it, and the date it was purchased.

You can also set policies and restrictions on the personal use of office furniture to prevent possible abuse.

In addition, if the furniture is temporarily used outside the workplace, the necessary reasons and documentation should be collected to justify this use.

Such measures will not only help with financial transparency but will also prevent potential problems in tax audits.

Therefore, by proving the office and business use of your furniture, you can easily claim a tax deduction for its purchase.

The tax deduction for office furniture depends on factors such as the type of furniture, the duration of use, and how it is used.

Businesses should update their information and awareness of the new tax laws and use financial advisors to make the right decisions.

If office furniture is purchased for business use and has a defined useful life, they can deduct it from taxes and benefit from tax deduction.

Requirements for home office tax deductions

If you use your home as an office, you can claim office furniture as a business expense on your tax return.

However, tax laws are a bit stricter in this case, and a home office must meet certain conditions to be able to deduct the cost of office furniture from your taxes.

1. Exclusive and regular use of the space

One of the most important requirements for deducting the cost of furniture in a home office is that the room or portion of your home space is used exclusively and regularly for business activities.

If the space is used jointly for work and personal life, it will generally not qualify for an office furniture tax deduction.

The reason for this is that without these restrictions, individuals can report their personal expenses as business expenses and illegally pay less tax.

Therefore, in order to claim the deduction for your furniture, it must be proven that the space is used exclusively for professional activities.

2. Principal Place of Business

Your home office must be your principal place of business.

This means that the majority of your business must be conducted from your home office and you do not have another physical office to conduct your business.

If you have a physical office at another business location but also occasionally work from home, you are likely not eligible to deduct the cost of office furniture.

Having documentation such as meeting schedules, work records, business correspondence, and even a list of clients who receive services from this office can help prove this claim.

Self-employed individuals and freelancers who use their home or personal space for professional activities can deduct some of the office furniture costs from their taxes.

This option helps them offset some of the costs associated with furnishing their office and take advantage of the tax deduction.

However, to benefit from this exemption, the specific conditions we mentioned about home offices must also be met here.

You Might Also Enjoy: How To Arrange Office Furniture: 2025 Guide

Common Missteps and How to Avoid Them

When reporting office furniture expenses for tax purposes, many businesses, especially the self-employed and freelancers, make mistakes that could lead to their claim being rejected by the IRS.

To avoid tax problems and ensure that office furniture expenses are properly deducted, follow these tips:

- Only report items that are used exclusively for business purposes.

- Keep receipts and proof of purchase for office furniture so that they are available if needed. Also, use a business bank account for business purchases.

- Be aware of the tax laws and annual changes in your state to report expenses correctly.

- If necessary, seek the help of a professional tax advisor to avoid costly errors.

Conclusion

As mentioned in this article, office furniture is tax deductible under certain circumstances.

This is especially a great benefit for small businesses, self-employed individuals and freelancers to reduce expenses.

To take advantage of these benefits, it is best to be aware of the relevant rules, namely Section 179 of the tax code, how to apply depreciation, and the correct way to record the business use of furniture.

Since tax laws can change every year, staying up-to-date and aware of new changes can help you pay less tax and save on your expenses.

To ensure that you take advantage of this opportunity, it is recommended to consult a professional tax advisor.

This can help you avoid tax mistakes, maximize your legal deductions, and properly manage your business expenses.

John Ofield is a recognized expert in the office furniture and office cubicle industry, with over 40 years of experience. As the founder of ROSI Office Systems, he specializes in space planning, custom cubicle designs, and high-quality commercial furniture. John’s expertise helps businesses enhance productivity and collaboration. He is also dedicated to mentoring entrepreneurs and redefining workspaces to inspire success.