In today’s businesses, any purchase, including office furniture, can have a profound impact on a company’s financial situation. But is purchasing office furniture an asset or an expense?

Let’s answer this question! In 2025, office furniture is typically considered a capital asset if it has a useful life of more than one year and is used to generate income. However, it can also be classified as an expense for businesses using a lease or in cases where the furniture is purchased with the intent to depreciate over time.

Proper accounting depends on the furniture’s cost, usage, and lifespan.

In 2025, office furniture classification will directly impact financial reporting, budget planning, sustainable company growth, and tax deductions.

The right decision to purchase office furniture is based on whether your purchase is an asset that will help the company grow in the future and increase its productivity, or is it just a current expense.

To make the right decision, we must first understand the difference between an asset and an expense.

Incorrect decisions can affect financial statements, taxes paid, and budget planning in a company.

What is an asset?

In financial accounting, assets are economic resources that a company owns and that can be converted into cash or generate future economic benefits for the company.

These resources can take many forms, such as cash, equipment, real estate, and even intellectual property.

Assets usually contribute to the company’s financial growth and sustainability and are held by the company for more than one year.

Assets are also recorded in the assets section of a company’s balance sheet and represent its capital.

What is an expense?

In accounting, an expense is the expenditure that a business incurs to carry out its daily operations in order to earn income.

These expenses include operating expenses such as paying employees, renting, and purchasing raw materials.

These types of expenses are necessary to maintain and continue the company’s operations and are usually deducted from the company’s income in the same fiscal year.

Capital expenses are used to purchase long-term assets that depreciate in value over time.

For example, purchasing office furniture and developing technology infrastructure are among the operating expenses that are reflected in the financial statements over time.

You Might Also Enjoy: What Are The Best Brands Of Office Furniture In 2025

When is office furniture classified as an asset?

In financial accounting, office furniture can be considered an asset, but it must meet certain conditions.

This affects how businesses report their financial statements, depreciation, and tax benefits.

- Capitalization: Office furniture is an asset when a company and its accounting policies record office furniture as a long-term asset.

In this case, the company must consider its useful life and cost.

Expensive purchases usually qualify for capitalization.

- Depreciation: Assets such as office furniture are depreciated over a number of years and are not deducted from the company’s profits in the same year, unlike current expenses.

Since depreciation is the reduction in the value of an asset, companies can spread the cost of purchasing office furniture over a period of years, which reduces the tax burden in a particular year.

This helps reduce tax liability and improve the company’s cash flow.

When can office furniture be recorded as an expense?

- Purchases below a threshold: There is a specific threshold set by the IRS below which office furniture purchases can be recorded as a current expense in the same year and deducted from profits.

- Short-term furniture or rental furniture: If a company leases or purchases office furniture for short-term use, it can report it as an expense in the same year.

Also, under Section 179 of the tax code, businesses can deduct some purchases, including office furniture, as an expense in the same year.

This means that instead of waiting years for depreciation benefits, you can claim the full deduction in 2025.

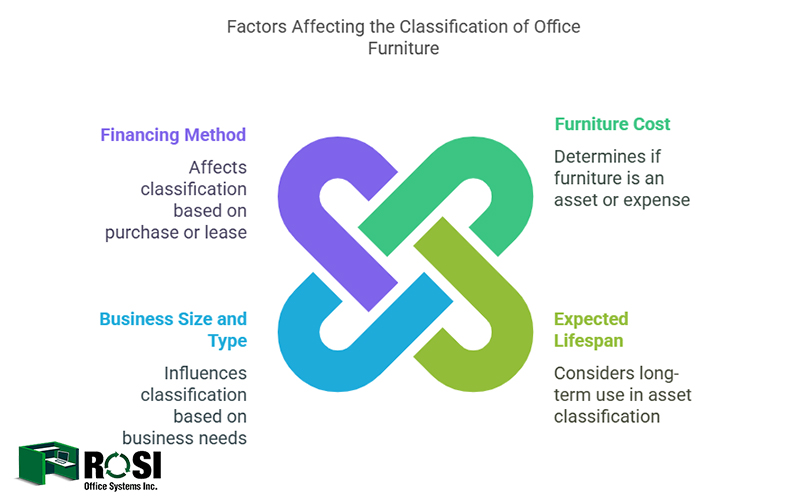

Factors Affecting the Classification of Office Furniture

1. Furniture Cost

Answer to this question: Is office furniture an asset? depends on the cost of purchasing it.

Small, low-cost purchases that do not exceed the IRS threshold are considered expenses and are deducted directly from income.

However, large office furniture purchases are classified as long-term assets and are depreciated over a period of time, based on the company’s accounting policies.

2. Expected Lifespan

Office furniture purchased for long-term use (more than one year) is considered an asset of the company.

Typically, this furniture has value and functionality that does not decrease over time or wear out quickly, so it can be used for consecutive years.

This characteristic makes it possible to consider it as a fixed asset from an accounting perspective, rather than as an immediate expense.

3. Business Size and Type

The classification of office furniture varies depending on the size of the business.

Large businesses record this equipment as a long-term asset due to the need for high-quality furniture and its long-term use.

Startups and small businesses, due to financial constraints, prefer to reduce costs and record office furniture as an expense.

4. Financing method

The different methods of acquiring office furniture affect its classification.

If the furniture is acquired on the lease and the business uses office furniture rental, it can be recorded as a current expense.

Because leases are recorded as periodic expenses in the financial statements.

On the other hand, if a company purchases office furniture, records it as an asset.

Tax Law Changes in 2025

In 2025, the tax laws have changed that affect how office furniture purchases are classified and recorded. One of the most significant changes is the change in the tax deduction limit for the purchase of business assets.

- Section 179 Tax Deduction: Under the new rules, the tax deduction limit for the purchase of assets, including office furniture, has changed, and businesses can deduct these expenses in the same year of purchase.

- Use of Bonus Depreciation: This rule allows businesses to fully deduct their office furniture purchases in the same year of purchase.

Key Considerations for Businesses in 2025

In 2025, there will be major changes in tax laws and accounting regulations that will have a significant impact on how office furniture is classified and reported.

For this reason, businesses should carefully consider how they record and calculate office furniture purchases.

New office furniture designs, such as ergonomic furniture and the integration of technology into the workplace, also require more careful assessment.

In addition, due to public awareness of environmental and sustainability issues, businesses are also paying more attention to protecting the environment.

Purchasing environmentally friendly office furniture can be considered as an influential factor in financial decisions.

This not only helps to preserve natural resources but can also bring financial benefits to companies in the long run.

You Might Also Enjoy: How To Arrange Office Furniture: 2025 Guide

Best Practices for Accounting Office Furniture

- Consult with accountants or financial experts: Don’t forget to consult with financial experts!

Consulting with them will help you understand how to properly classify and record expenses.

Accountants can also help businesses decide whether to record office furniture as an asset or an expense.

They are aware of new depreciation rules and tax calculations and can help you avoid financial mistakes.

- Maintain records of purchases, installations, and depreciation: Maintaining records of purchases, installations, and depreciation of office furniture is a key principle in financial accounting.

So make sure to accurately record them for use in financial reports.

These records include detailed information on the date of purchase, amount paid, installation steps, and how the furniture depreciated over time.

This information is also essential for tax and audit purposes.

- Use asset management and accounting software: Accounting and financial software helps companies accurately record information related to office furniture records.

Using this software, you can automatically record and report information related to asset value, duration of use, and depreciation.

- Leasing vs. Purchasing: Leasing or purchasing office furniture each has its own tax advantages and disadvantages.

The decision to choose either option depends on the financial needs and cash flow situation of your business.

Buying furniture allows a company to keep its physical assets for a long time and take advantage of tax benefits for depreciation.

Leasing allows a business to reduce its financial burden and spread the costs over a shorter period of time.

Conclusion

In this article, we examine the factors that influence the answer to the question, “Is office furniture an asset or an expense?”

The right choice between recording office furniture as an asset or an expense depends on factors such as price, business size, duration of use, and tax implications.

Professional financial advisors can help businesses make the best decision when purchasing office furniture.

By staying up-to-date on accounting rule changes in 2025, they can help companies take advantage of tax benefits and reduce costs.

Ultimately, making the right decision in this area can have a huge impact on improving cash flow and business sustainability.

Additionally, careful planning on how to record and manage office furniture purchases and documents can impact a company’s future financial decisions.

John Ofield is a recognized expert in the office furniture and office cubicle industry, with over 40 years of experience. As the founder of ROSI Office Systems, he specializes in space planning, custom cubicle designs, and high-quality commercial furniture. John’s expertise helps businesses enhance productivity and collaboration. He is also dedicated to mentoring entrepreneurs and redefining workspaces to inspire success.